Zero Cost Fha Streamline Refinance

But just because there are no upfront costs doesn t mean that your lender foots the bill for free.

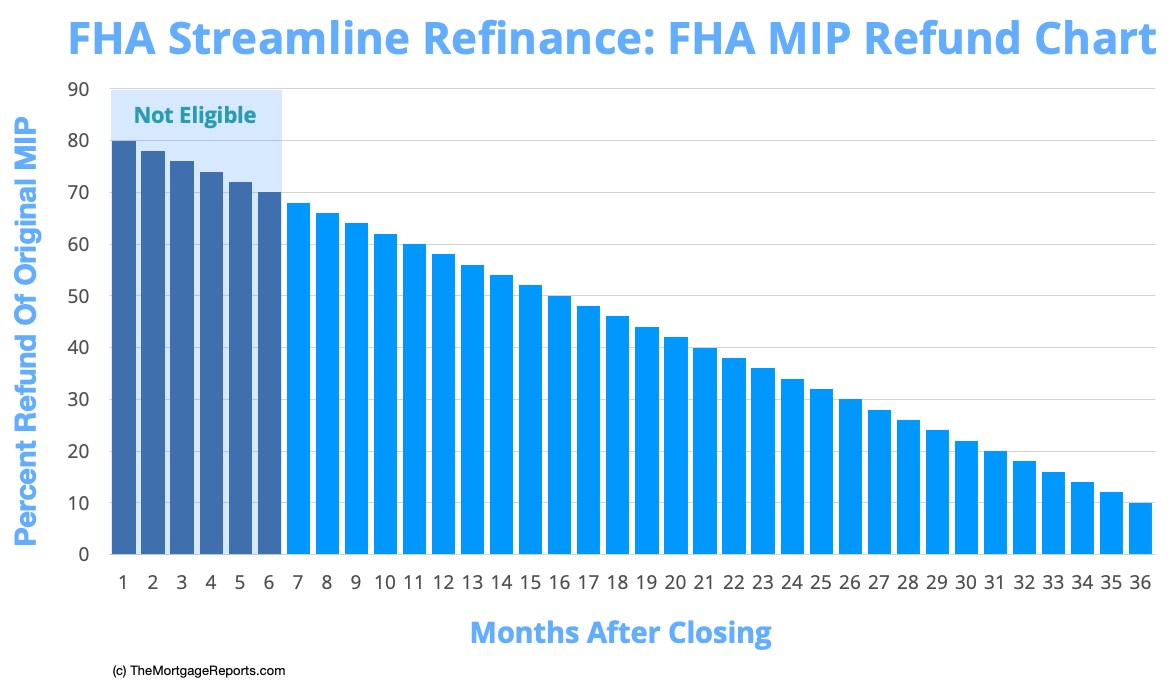

Zero cost fha streamline refinance. Lender paid closing costs on an fha streamline refinance. No private mortgage insurance pmi. For an fha streamline refinance replacing a loan endorsed on or after june 1 2009 the fha upfront mortgage insurance premium is equal to 1 75 percent of your loan size or 175 basis points. For example home appraisals can cost up to 600 which are added to closing costs.

No points or fees. The good news is that you don t always have to pay these costs out of pocket. Fha recently lowered its mortgage insurance premiums by 0 50. You won t have to get a new fha appraisal and with a non credit qualifying.

Maximum mortgage amount. Apply online for mortgage loans what is mortgage pmi with a naca mortgage consumers can buy a home with. Program helps current fha homeowners lower their rate and payment without most of the traditional refinance documentation. For case number assigned on or after april 9 2012 the ufmip will be 1 75.

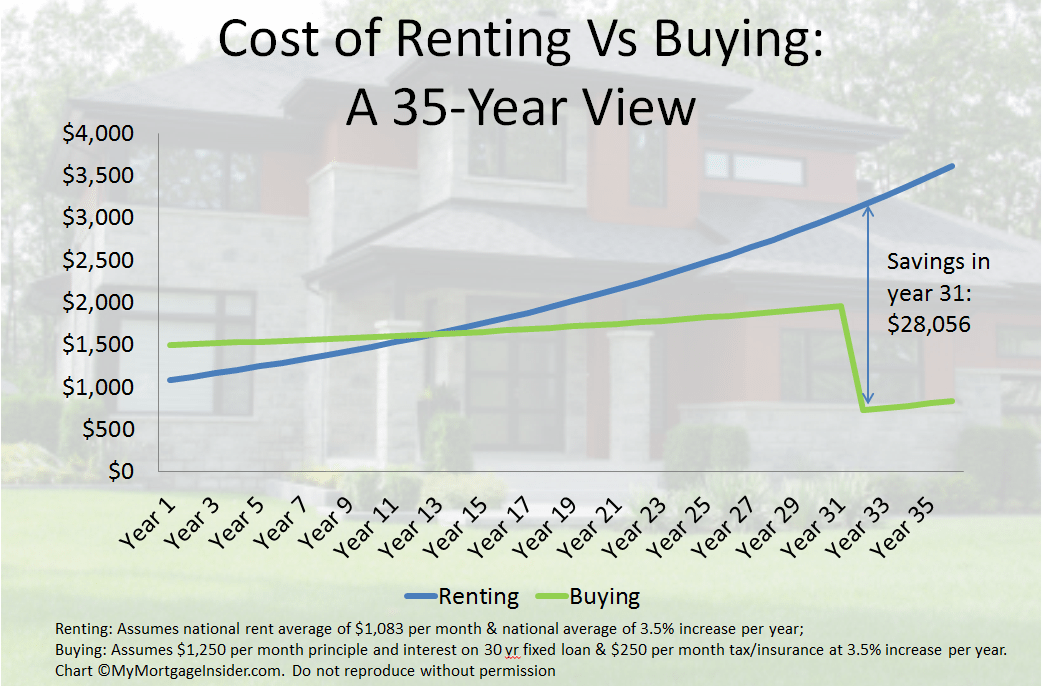

Though closing costs can vary widely depending on the lender borrower characteristics and the loan amount. As the name suggests a no closing cost refinance is a refinance where you don t have to pay closing costs when you get a new loan. Servicers are graded by a ranking of zero to five stars with five star designation being the highest recognition. For an fha streamline refinance typical closing costs range between 1 500 and 4 000.

Must use the streamline refinance without appraisal worksheet 3 ufmip. With an fha streamline refinance homeowners can skip the step and ultimately reduce their out of pocket costs. So if your loan is 200 000 you are looking at approximately 6000 in up front costs. Effective for fha loans for which the case number is assigned on or after october 4 2010 the ufmip will be 1 00.

The new fha streamline refinance program requires very little documentation no appraisal no credit check no income or employment verification and zero underwriting fees. No closing cost refinances don t get rid of your expenses. Overall the fha streamline refinance is an excellent option for a current fha mortgage holder to save money with a refinance. What is a fha streamline refinance and what do you need to qualify.

The latter is called a zero cost fha streamline. The fha streamline refinance. They only move them into your principal or exchange them for a higher interest rate. This reduces the closing.