Retirement Plan Ira

Waivers of the 60 day rollover requirement.

Retirement plan ira. The short answer is yes most retirement plans allow a former employee to roll their plan funds over into an ira after they ve left their employer s service. An individual retirement account ira in the united states is a form of individual retirement plan provided by many financial institutions that provides tax advantages for retirement savings. A 401 k and ira are both tax advantaged retirement accounts but 401 k s are offered by employers who often match employee contributions whereas iras can be opened by individuals with any. The why what how when and where about moving your retirement savings.

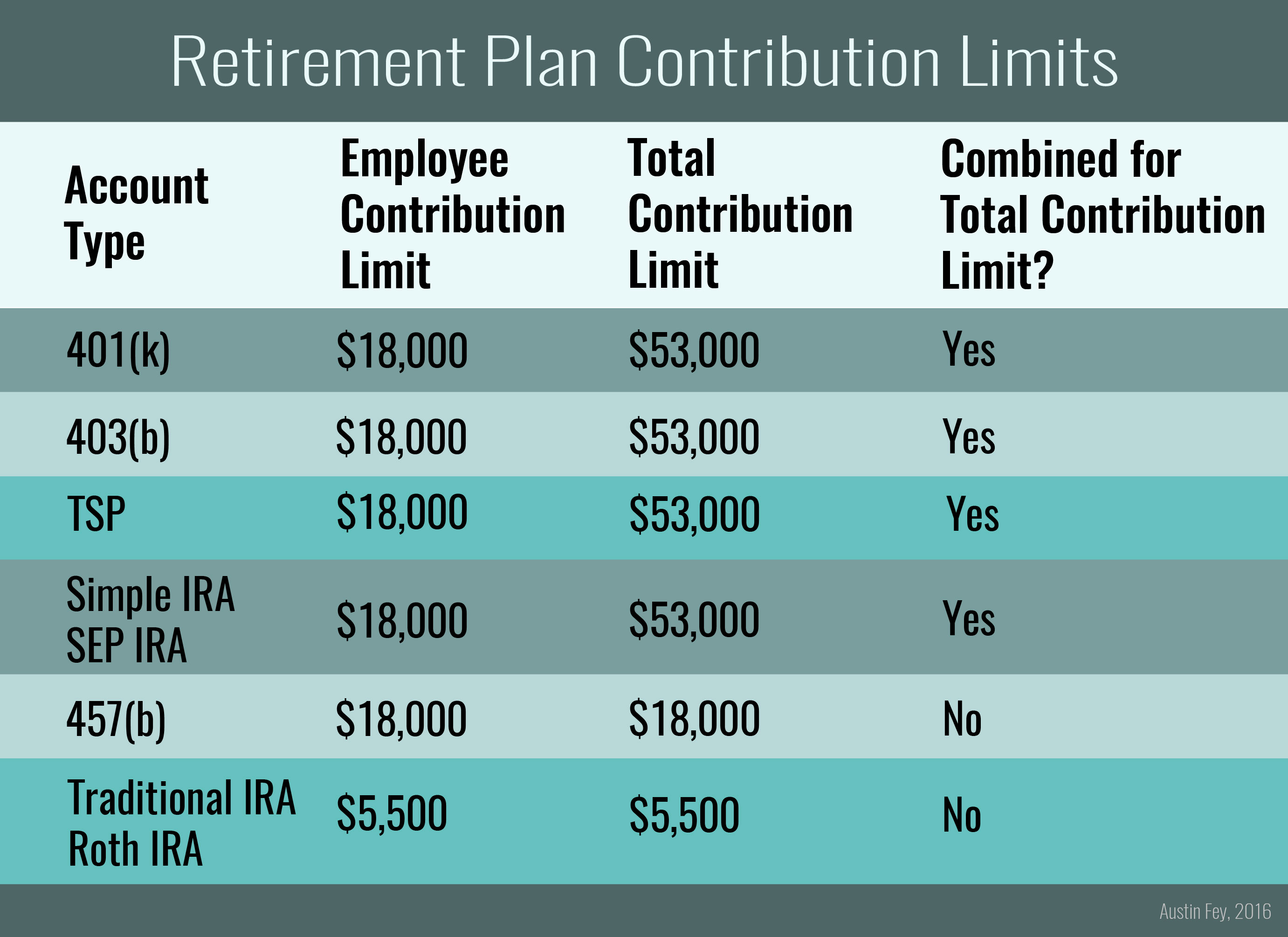

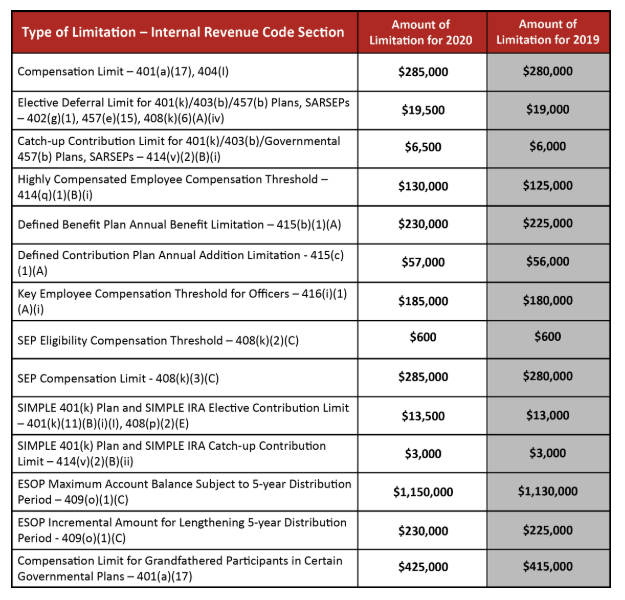

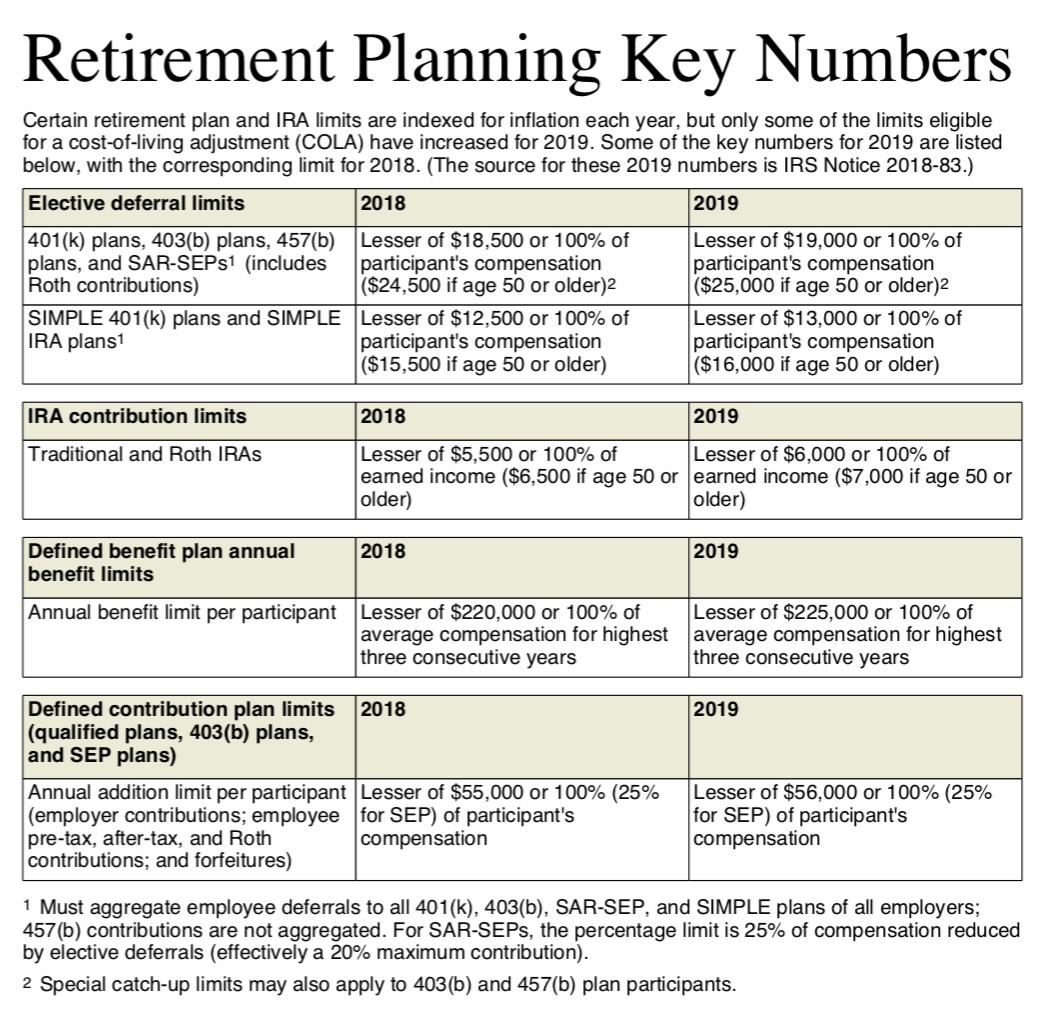

An individual retirement account is a type of individual retirement arrangement as described in irs publication 590 individual retirement arrangements iras. Youtube video ira retirement plan 60 day rollover waivers 57 secs youtube video retirement plan and ira rollovers 1 20 mins distributions taking withdrawals from your ira when. The savings incentive match for employees simple ira is a retirement plan that small businesses with up to 100 employees can offer. There are several types of iras as of 2020.

In general section 2202 of the cares act provides for expanded distribution options and favorable tax treatment for up to 100 000 of coronavirus related distributions from eligible retirement plans certain employer retirement plans such as section 401 k and 403 b plans and iras to qualified individuals as well as special rollover rules with respect to such distributions. An ira is an account set up at a financial institution that allows an individual to save for retirement with tax free growth or on a tax deferred basis. An individual retirement account ira is a tax advantaged investing tool that individuals use to earmark funds for retirement savings. You may contribute to an employer sponsored retirement plan and an ira in the same year and you may contribute to tax deferred and roth accounts at the same time but you may not make more than.

It works very much like a 401 k. Learn more about iras and how these retirement savings accounts can help you save for your retirement. The waiver applies to distributions taken between january 1 2020 and.

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

:max_bytes(150000):strip_icc()/GettyImages-91837283-49f5b85ed6fd49e0973e2c6a1c37691d.jpg)