Reverse Mortgage Lump Sum

Generally this occurs when the borrower uses the hecm for purchase program or to pay off a large existing mortgage on the property.

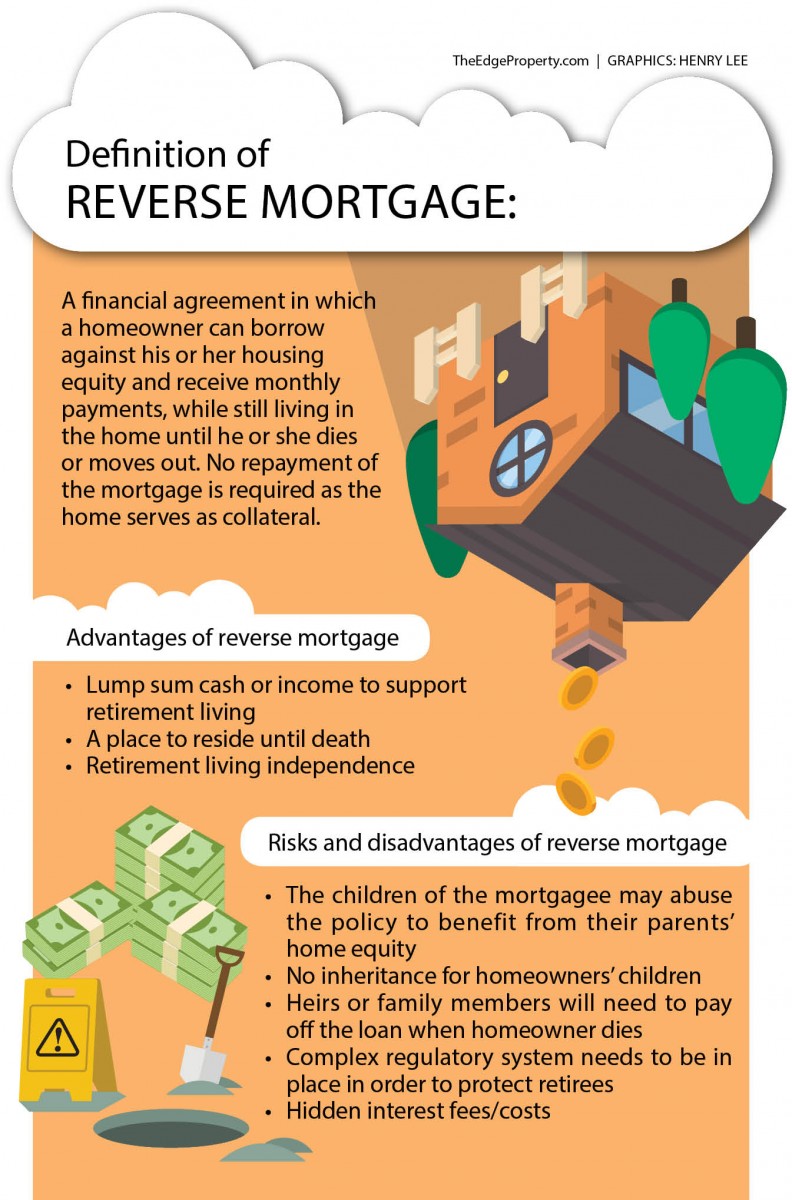

Reverse mortgage lump sum. It is worth noting. The program can offer a single lump sum payment a credit line or lifetime monthly income. The reverse mortgage program is not a one size fits all program. Lump sum or monthly payouts.

Under this option all of the available loan proceeds are accessed at closing. And moderator of arlo has 40 years of experience in the mortgage banking industry and has devoted the past 15 years to reverse mortgages exclusively. Branson 8 comments if i do a reverse mortgage can i pull all the money up front as a lump sum or do i have to have a line of credit and is there cost to pulling out all the money up front. For example if your home is worth 500 000 and your plf is 50 you can borrow 250 000.

Lower cost than a lump sum payment because you ll be paying interest and fees only on the money you ve drawn. Your property value or 625 000 which ever is lower is multiplied by the plf to come up with your maximum loan. Reverse mortgage initial principal limit is the amount of money a reverse mortgage borrower can receive from the loan. With a bay area reverse mortgage you can have the equity in your home dispersed in a large lump sum payment or on a regular monthly cash flow so you can plan and enjoy the life you deserve without worrying about payments and having a place to live into your retirement years.

Only one reverse mortgage payment plan the single disbursement lump sum has a fixed interest rate. Single disbursement lump sum. You ve lived in your home for years and accumulated a good equity position. More single disbursement lump sum payment plan.

Start by inputting the youngest co borrower s age your estimated home value outstanding mortgage balance if applicable and your zip code. Term fixed monthly payouts for a set number of years or tenure fixed monthly payouts as long as you maintain the reverse mortgage and the payout does not cause the balance to exceed the amount stated in the mortgage. Find out how much you could potentially borrow using our reverse mortgage lump sum calculator. Taking out a fixed sum with a fixed interest rate is normally a low risk way to borrow.

Because not all borrowers have similar needs a reverse mortgage can be tailored to each homeowner s situation. Lump sum payout vs line of credit may 30 2019 by michael g.