Reverse Mortgage Rate

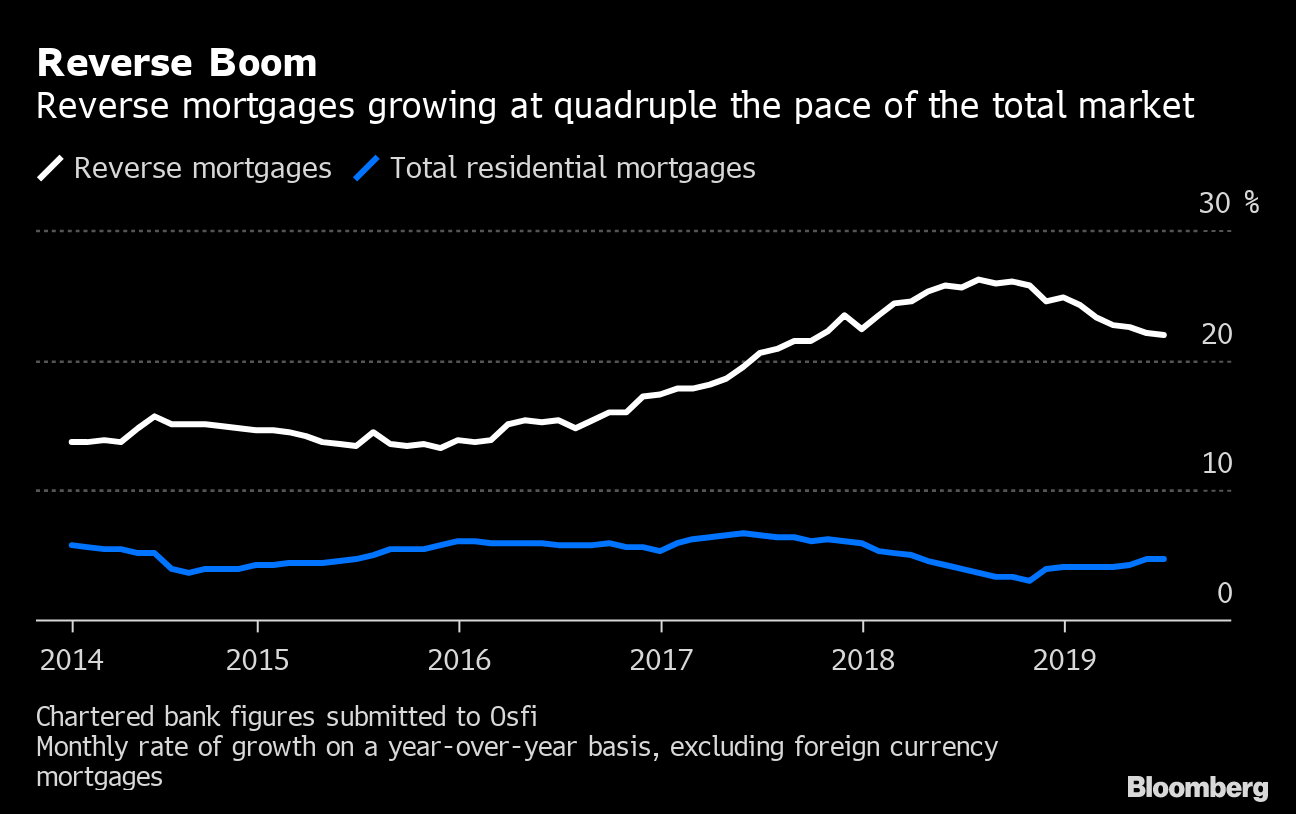

When we rated reverse mortgages in early 2017 the interest rates on offer for reverse mortgages ranged from 6 19 to 6 37 with an average rate of 6 25.

Reverse mortgage rate. There are also varying fees charged on a reverse mortgage much as there are for a standard home loan. To get the apr the lender would need to disclose insurance and closing costs. With an adjustable rate reverse mortgage loan the borrower must put all funds that are available after the payoff of liens into a line of credit or a tenure monthly payments. An interest rate of 6 20 p a.

As the interest compounds the loan amount can. The reverse mortgage interest rate and the closing and administrative cost are added together to determine the annual percentage rate known as the apr. A portion of the line of credit is considered immediately available max upfront cash. A reverse mortgage is a loan that pays you cash requires almost no proof of income and entails no payments until you leave your home.

Compounded monthly including applicable fees or charges and no repayments being made has been used in this example. What is a reverse mortgage. The answer to that depends on what term you prefer. Using a reverse mortgage homeowners can get the cash they need at rates starting at less than 3 5 per year.

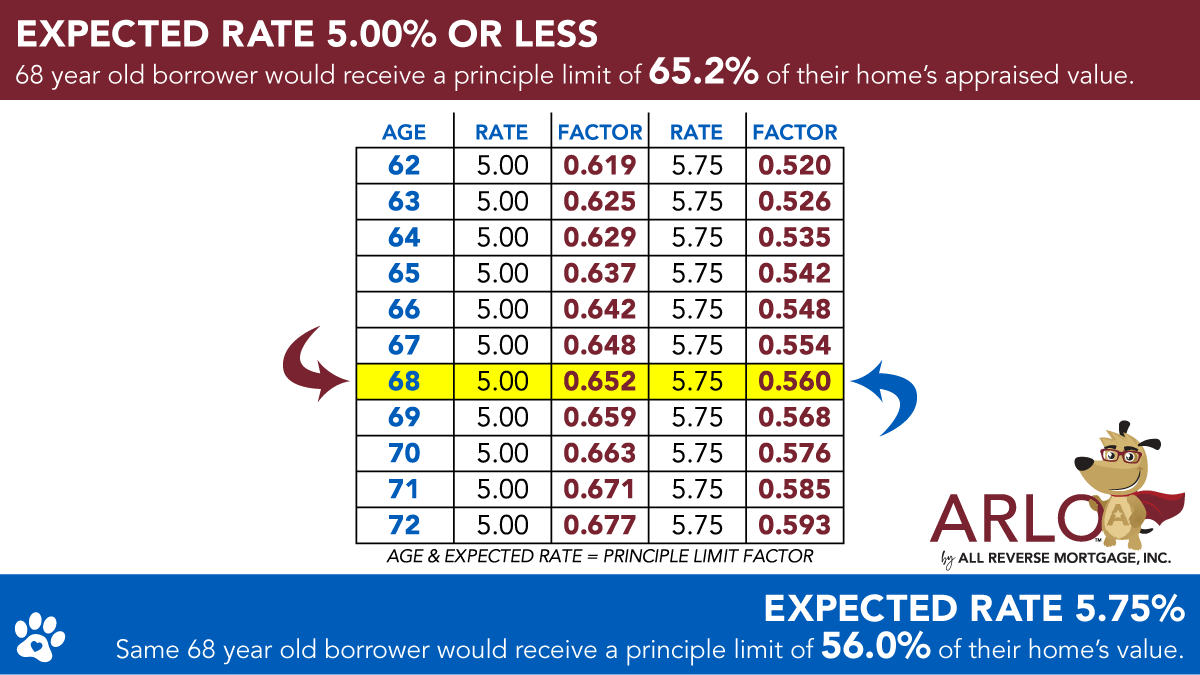

The apr is calculated by determining what the total interest cost would be over a five year period then adding the closing fee and turning that total cost into an annual rate. The average fees in 2017 were as follows. An average variable rate on a reverse mortgage is at the time of writing around 6 25 7 25 however this will vary from lender to lender. Let s say that a lender is offering you a fixed rate reverse mortgage at a rate of 4 2.

Think of a reverse mortgage as a conventional mortgage. We also know that annual mip will equal 0 5 of the loan balance. A 5 year fixed reverse mortgage rate for example is usually at least two thirds of a percentage point greater than a variable or 1 year fixed. 4 20 0 5 4 70.

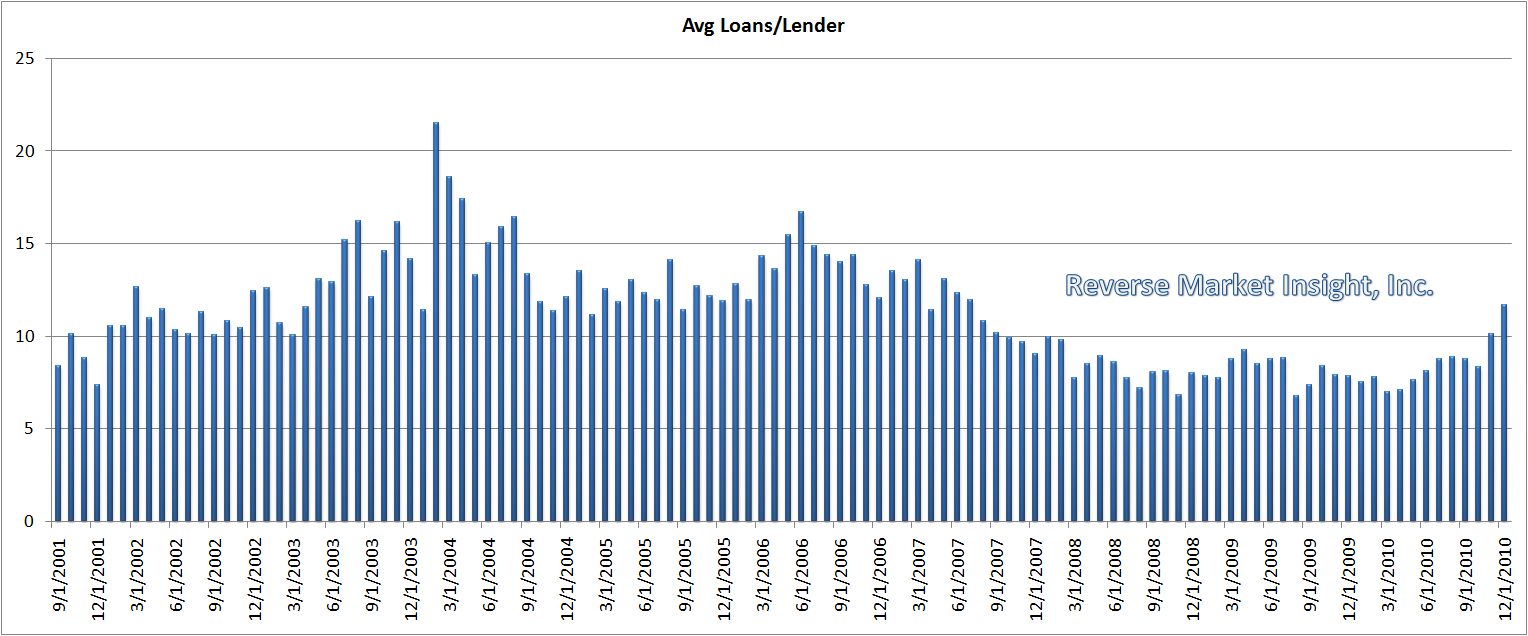

Below you ll find the latest average interest rates for home equity conversion mortgages the most common type of reverse mortgage. What is the current interest rate for a reverse mortgage. What to look for in a reverse mortgage price. Interest rates are subject to change without notice.

What is the best reverse mortgage rate. Presently the lowest fixed interest rate on a fixed reverse mortgage is 3 31 4 31 apr and variable rates are as low as 2 63 with a 1 96 margin. And is subject to change. Different interest rates may apply.

In this case you would calculate the rate by adding the two together.

/GettyImages-1066908212-df93740a51b44601ae80a047a0e2d9dc.jpg)