Rolling Over Ira To 401k

Once you re 100 positive that your employer 401k accepts a rollover contribution from your ira you can request a distribution from your ira.

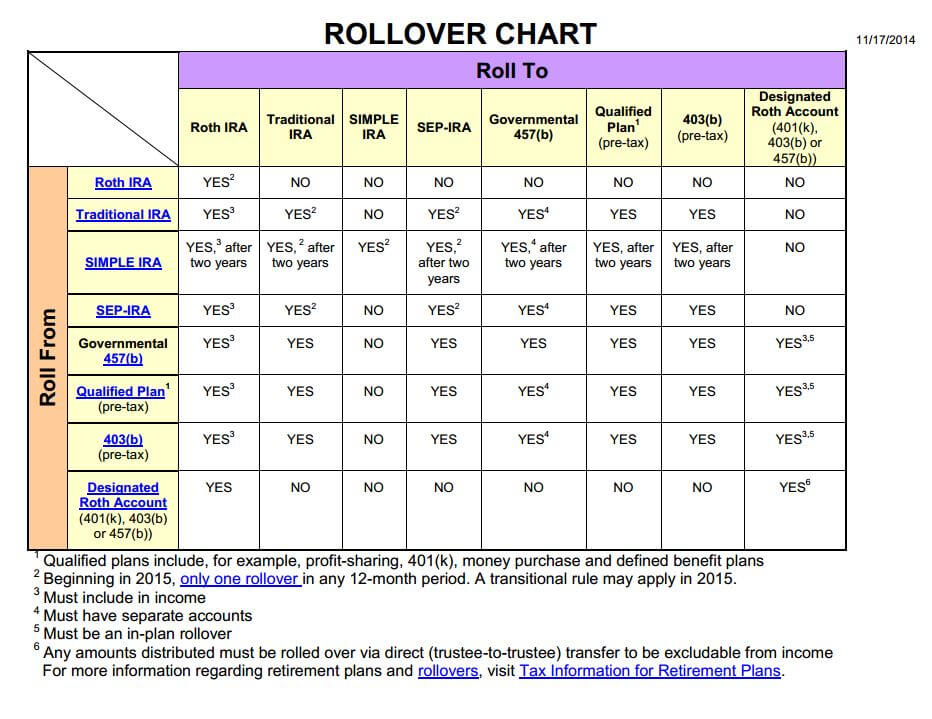

Rolling over ira to 401k. Same goes for a roth 401 k to roth ira rollover. For most people rolling over a 401 k or the 403 b cousin for those in the public or nonprofit sector into an ira is the best choice. Plus you may pay less in account fees. A rollover ira can be a traditional ira with the same withdrawal rules or you can open a rollover ira that s a roth that s what you would do to roll money from a roth 401 k.

By bringing your old 401 k s and iras together you can manage your retirement savings more efficiently. Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets. First you roll over the money to an ira then you convert it to a roth ira. A ira to 401 k rollover offers benefits such as earlier access to the money and easier conversion to a roth.

Drawbacks include limited investment selection and loopholes for withdrawals. How to move your old 401 k into a rollover ira. To do a rollover from a traditional 401 k to a roth ira however is a two step process. 60 day rollover if a distribution from an ira or a retirement plan is paid directly to you you can deposit all or a portion of it in an ira or a retirement plan within 60 days.

Each ira provider has it s own policies and procedures for doing a distribution but you should be prepared to fill out a form and select the reason why you re requesting the distribution. You can only roll an ira into a 401 k if the provider is willing and able to accept the deposit. Deciding which ira to choose. How to do an ira rollover to a 401 k without tax penalties first you must check your eligibility.

Rolling over a 401 k is an opportunity to simplify your finances. Beyond the type of ira you want to open you ll need choose a financial institution to invest with. You can t roll a roth 401 k into a traditional ira. Taxes will be withheld from a distribution from a retirement plan see below so you ll have to use other funds to roll over the full amount of the distribution.