Taxes Insurance

Driving tests and learning to drive or ride.

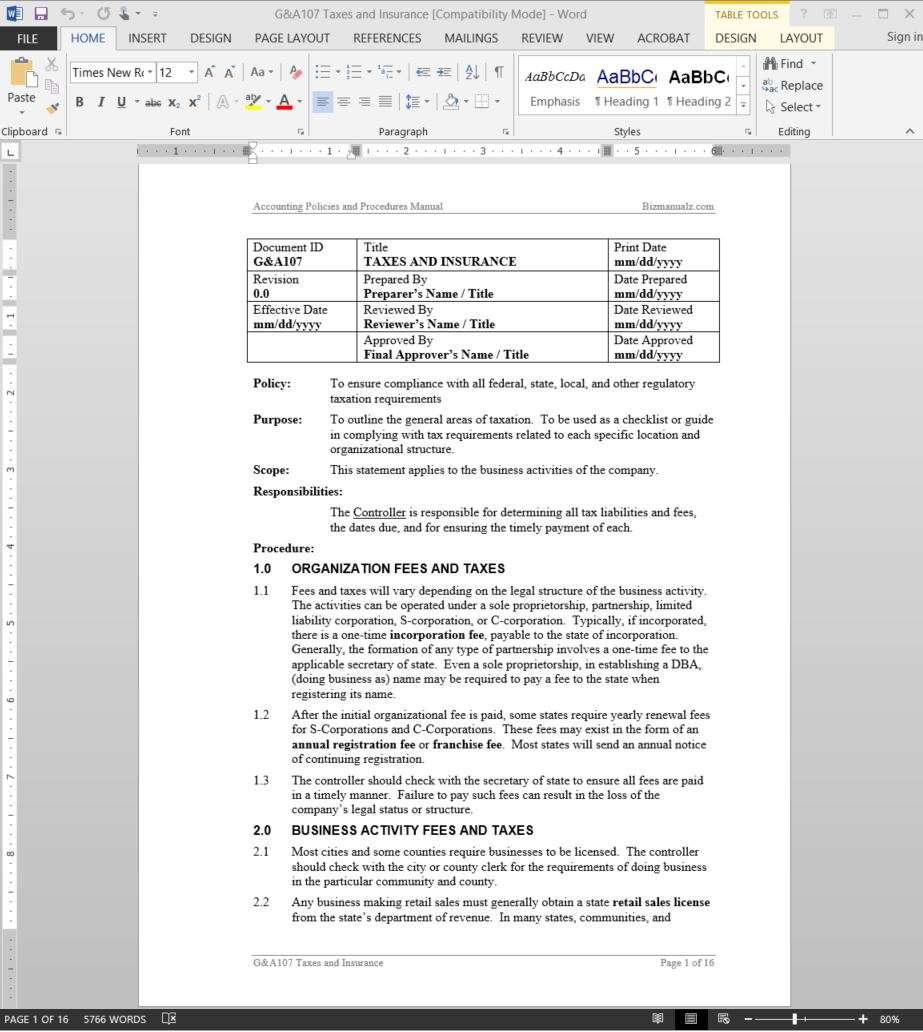

Taxes insurance. An escrow account or an impound account is a special account that holds the money owed for expenses like mortgage insurance premiums and property taxes. Group medical insurance which is provided in lieu of medical cost that would have been reimbursed by employers and the. Control freaks who find this objectionable and have equity of 20. Vehicle tax mot and insurance.

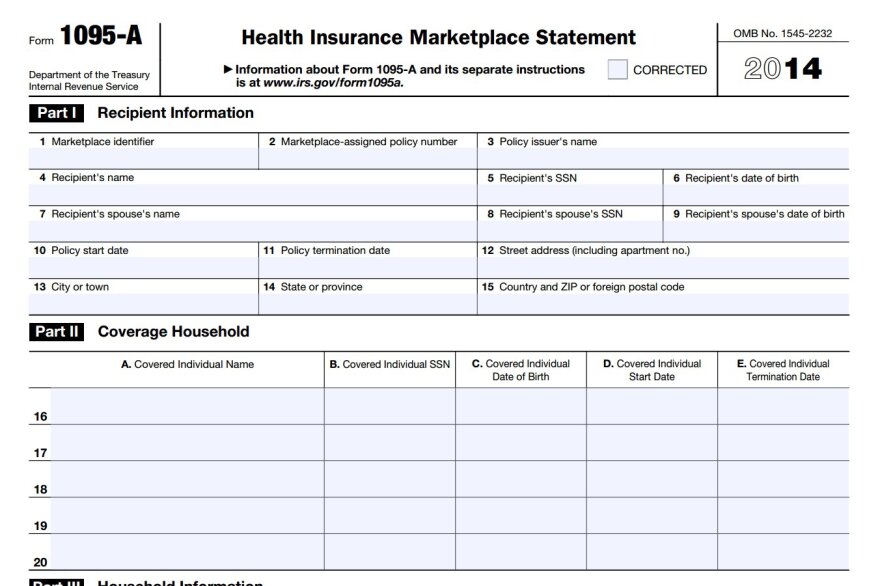

Like real estate taxes insurance premiums can be paid with each mortgage installment nd held in escrow until the bill is due. Transaction parties have often relied upon tax insurance to navigate tax exposures in m a transactions and corporate taxpayers are now seeing it as a means to address ongoing business tax risk. For the tax year 2019 the irs considers an hdhp an individual insurance policy with a deductible of at least 1 350 or a family policy with a deductible of at least 2 700. You paid insurance premiums in 2019 on your own life insurance policy.

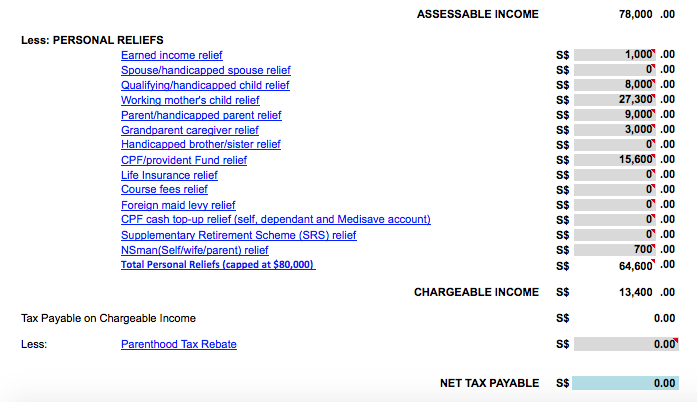

Number plates vehicle registration and log books. Life insurance relief cannot be claimed on premiums paid on an accident or health policy that provides for the payment of policy monies on the death of a person. And the insurance company must have an office or branch in singapore if your policies are taken on or after 10 august 1973. There are two types of insurance coverage that may be.

Mortgage borrowers must include taxes and insurance payments in their monthly mortgage payment for deposit in an escrow account. If you re buying a home your lender might collect a certain amount of money and deposit it into your escrow account during the closing process. Where employees are the beneficiaries of an insurance policy taken out by the employer the insurance protection is a benefit in kind derived from employment and taxable under section 10 1 b of the income tax act except for. The uk government introduced the insurance premium tax to raise revenue from the insurance sector which was viewed as being under.

Buy sell or scrap a vehicle. Tax insurance can protect against unanticipated or ill timed occurrence of a tax loss. Insurance payments that are designed to replace or supplement income may also be subject to taxes.

.jpg)