Types Of Business Insurance Coverage

To ensure that enough liability coverage is in place for extreme circumstances like a lawsuit that exceeds 1 million in damages many businesses buy a commercial umbrella liability policy.

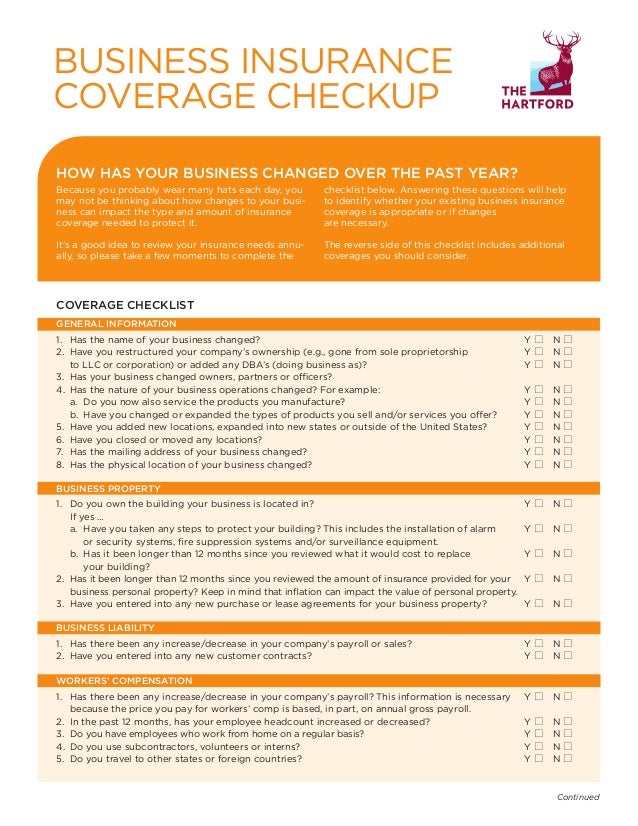

Types of business insurance coverage. The coverage your business requires depends on the things such as the industry its location number of employees and size. Every business even if home based needs to have liability insurance. Learn more about the different types of insurance for companies and how to choose the right protection for your business. You get business insurance through an insurance agent an online insurance marketplace or the insurance company s website.

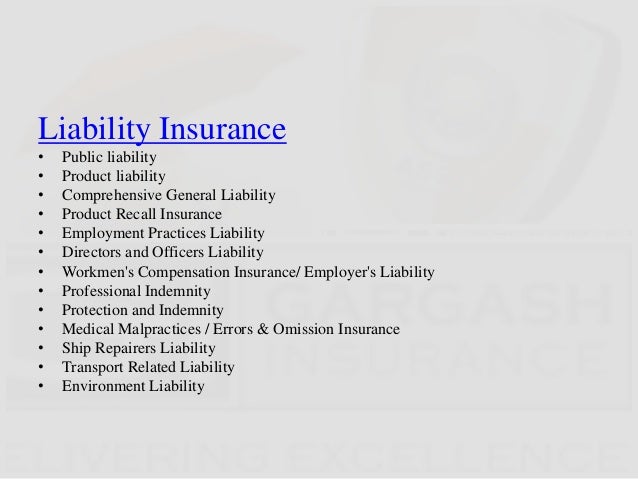

These may be purchased individually under separate forms or in combination under a single form. Certain types of insurance such as workers compensation and unemployment insurance coverage for workers are governed by state law and may be part of a state arrangement depending on the state. Business insurance covers lawsuits as long as you have the appropriate business liability insurance for your situation and enough liability coverage to pay your legal costs. Types of business insurance.

Business income insurance covers income your company loses when your business premises is damaged by a covered peril and your business must reduce or suspend its operations. The two most common types of time element insurance are business income and extra expenses coverages. This small business insurance covers your employees in case of a job loss or termination. The policy provides both defense and damages if you your employees or your products or.

Trying to choose the right types of business insurance can be overwhelming. Unlike workers comp or many of the other types of business insurance we ll discuss unemployment insurance is not something that you purchase from an insurance carrier.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)