Va Loan 100 Financing

19 years experience helping veterans use their va benefit.

Va loan 100 financing. It means that the loan covers the total amount of the house price. Programs starting at a 580 credit score. Your florida va loan expert. Call 833 229 0656 now.

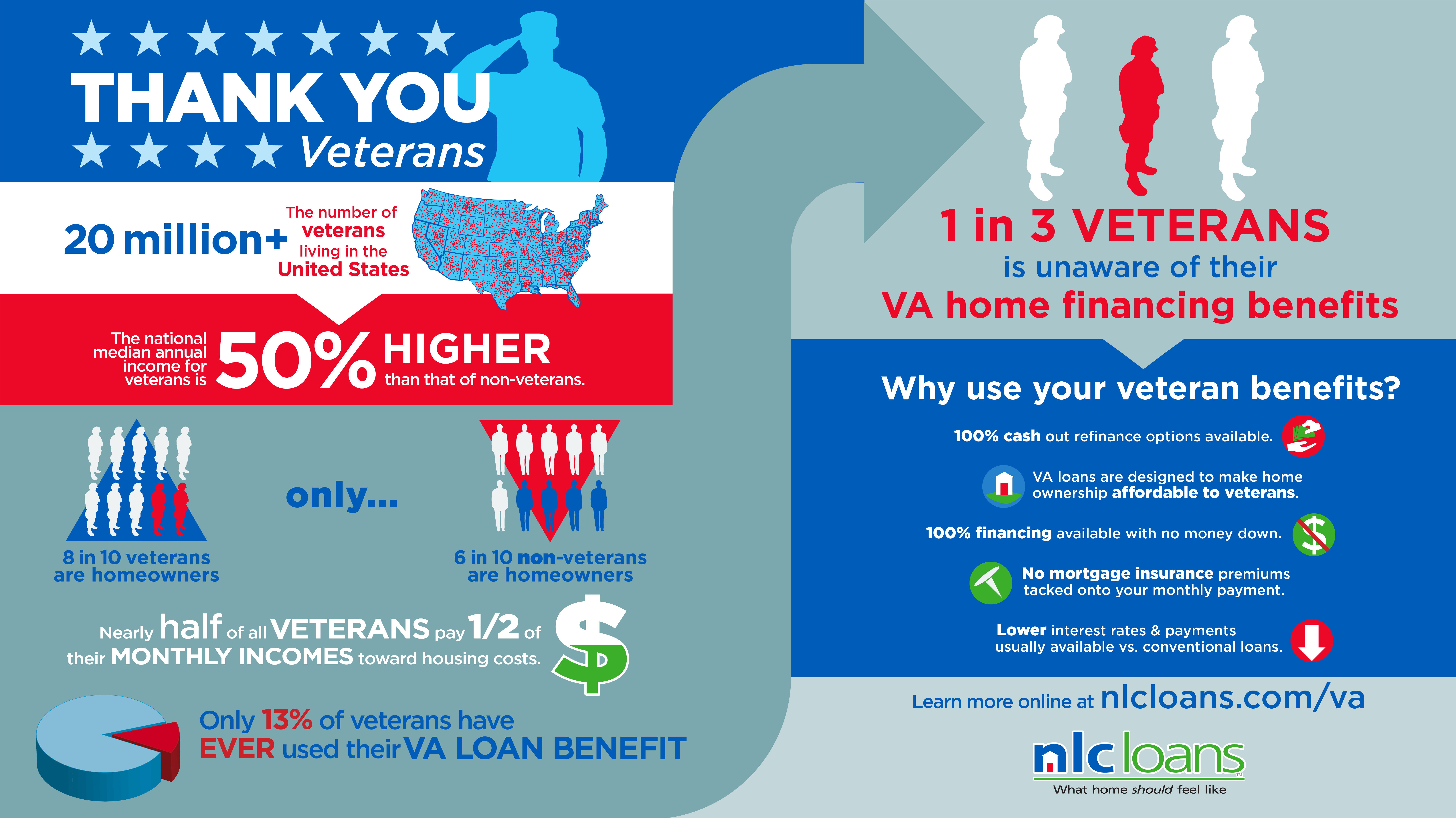

Qualifying veterans or active duty military may be able to use our va cash out refinance option to replace their conventional or fha loan with a lower rate va loan. Purchase or refinance including cash out. Find out the current loan limits and how they may affect the amount of money you can borrow using a va backed home loan without a down payment. 100 financing on va loans purchase or refinance.

Many people say 100 financing is impossible. Va nationwide lends up to 100 on va manufactured home loans on permanent foundations to build buy refi or renovate. 100 financing home loans. This loan is available to applicants typically with at least two years of former military experience or 90 days if still serving.

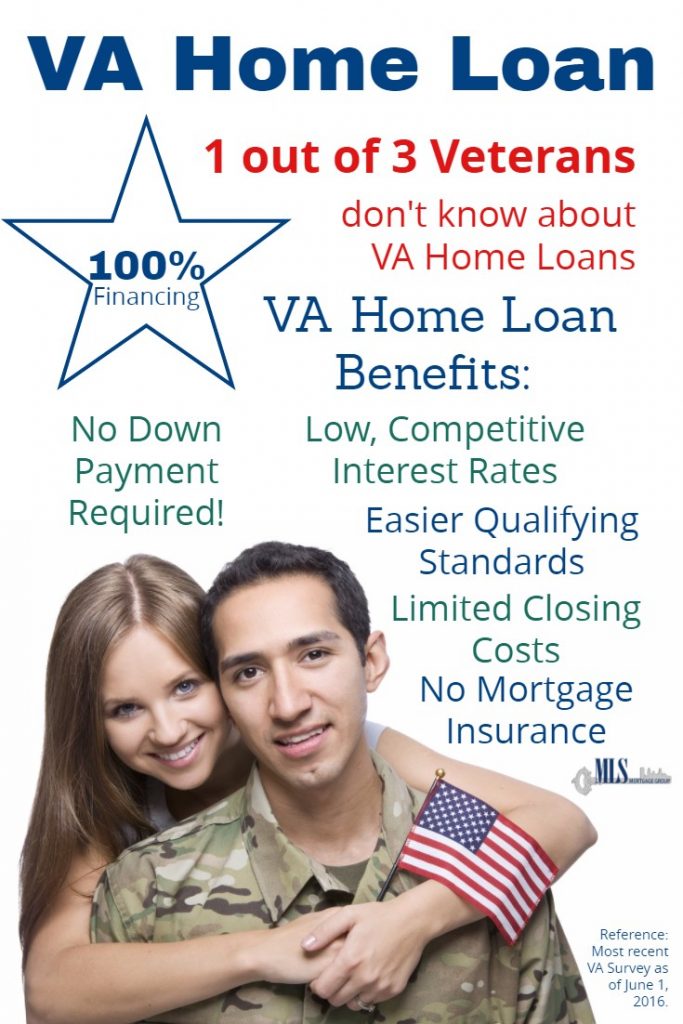

This is a great way to take advantage of the many benefits our va 100 program offers especially its lower interest rates no private mortgage insurance requirement and easier qualification process. The va home loan. In other words no down payments. The va loan is a chance for us to serve those who have served our country.

This easy qualifier only takes 60 seconds. Learn about va home loan limits also called va home loan maximums. Another mortgage loan that allows you to finance 100 of the home s cost is the va home loan. We waive all lender fees for veterans.

What does 100 financing mean. The va loan allows active duty military reservists national guard veterans and eligible surviving spouses to secure mortgage financing often with no money down. The va funding fee is a one time payment that the veteran service member or survivor pays on a va backed or va direct home loan. As part of our mission to serve you we provide a home loan guaranty benefit and other housing related programs to help you buy build repair retain or adapt a home for your own personal occupancy.

Keep in mind that you can open a loan for more than the va loan limit. Well if you are a qualified veteran it is possible to get a 100 financing va loan. Learn about the va funding fee and other loan closing costs you may need to pay on your loan.