Regular Savings Account Definition

A share savings account is an essential foundation account at a credit union.

Regular savings account definition. Definition of savings account. A deposit account at a bank or savings and loan which pays interest but cannot be withdrawn by check writing. As the name suggests a regular savings account requires you to commit to putting aside a small amount of money each month. With a regular savings account you commit to paying in a certain amount each month.

A regular savings account is a type of bank account used to safely store your money while earning some interest. Traditionally transactions on savings accounts were widely recorded in a passbook and were. Regular savings accounts will give you the most interest when you pay into the account each month. Though these accounts typically pay a modest interest rate their safety and reliability make.

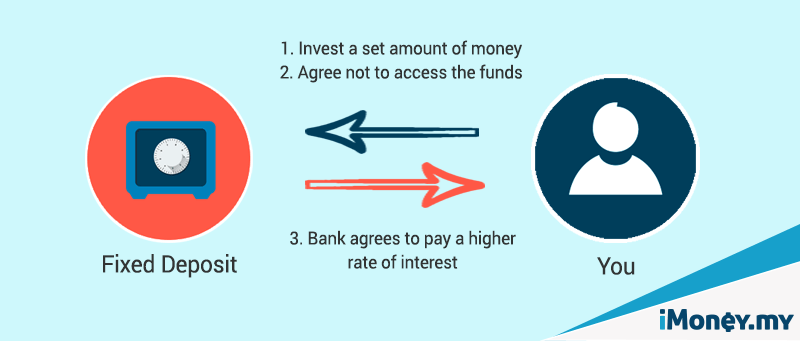

They can offer higher rates than some other savings as you need to make a monthly deposit. Compare every regular saver to get the best deal on your savings each month. These accounts are federally insured up to 250 000 and offer a safe place to put your money while earning. In return for guaranteeing a set level of income to your savings provider.

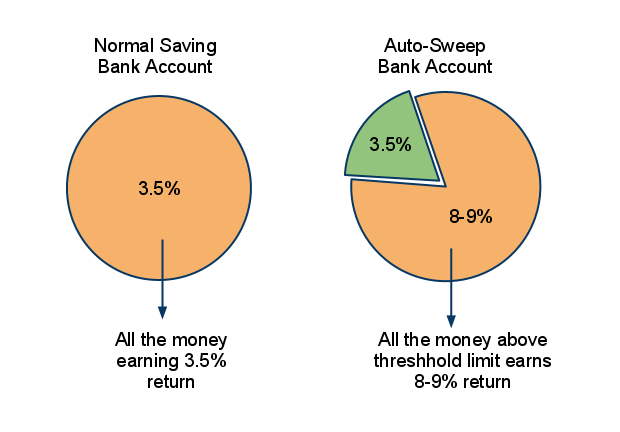

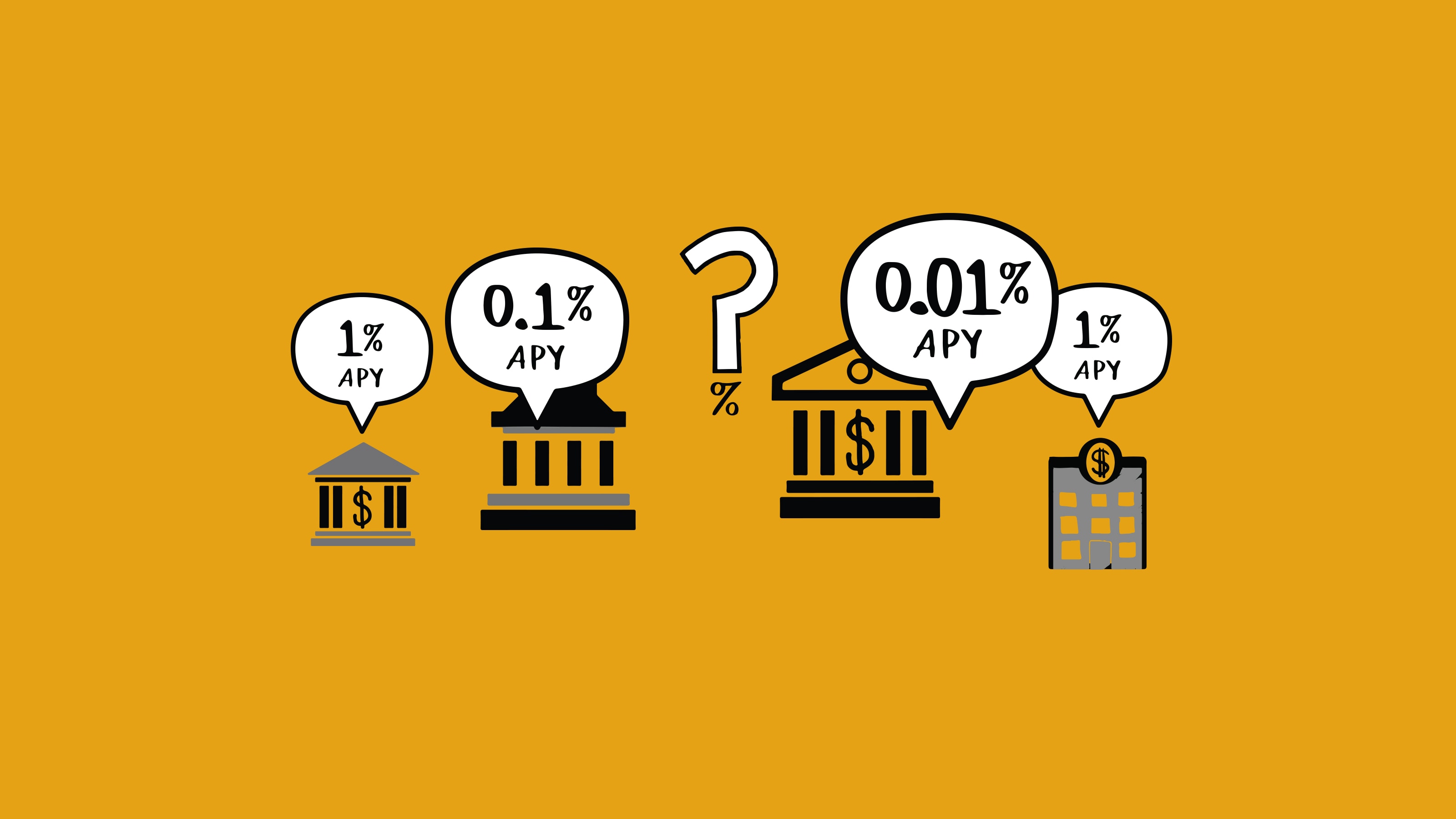

A savings account is an interest bearing deposit account held at a bank or other financial institution. In return the bank or building society gives you a higher interest rate than you d get with their current account or ordinary savings account. Regular savings accounts usually offer more favourable interest rates to those willing to deposit money every month. These accounts pay interest in the form of dividends on your savings providing a safe place to store cash.

A savings account is a basic type of financial product found at banks and credit unions.

:max_bytes(150000):strip_icc()/savings-accounts-4073268-FINAL-a1e0d68405b1455887d18059c7a14400.png)

:max_bytes(150000):strip_icc()/best-banks-for-savings-accounts-4160384-Final2-795d397d38b94d5d947f28da8f8671f4.png)

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)