What Institution Insures Individual Banking Accounts

The federal deposit insurance corporation protects consumers against loss if their bank or thrift institution fails.

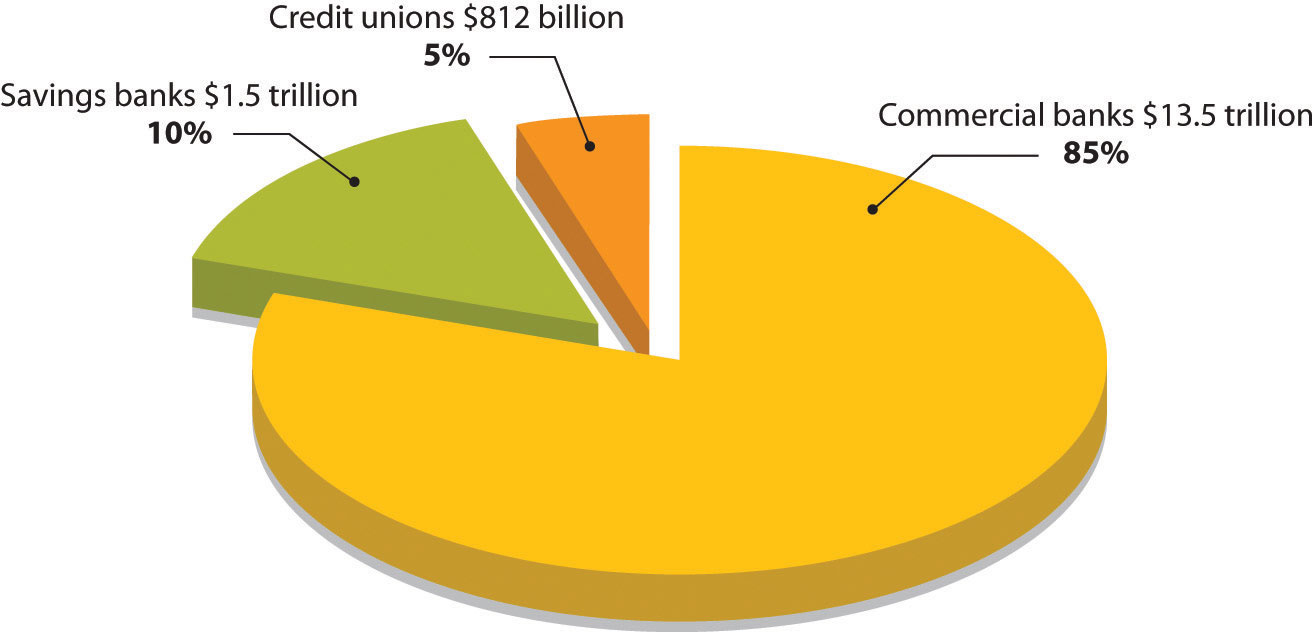

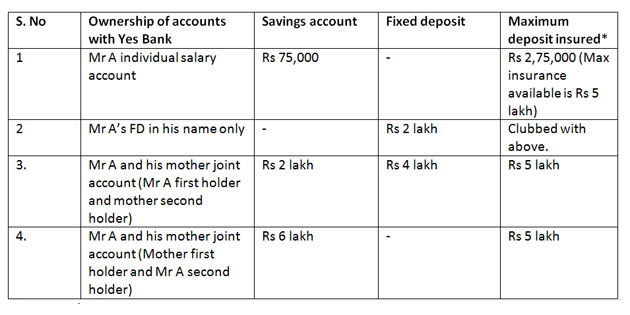

What institution insures individual banking accounts. The canada deposit insurance corporation cdic automatically insures your eligible deposits up to 100 000. For example if the same two co owners jointly own both a 350 000 cd and a 150 000 savings account at the same insured bank the two accounts would be added together and insured up to 500 000 providing up to 250 000 in insurance coverage for each co owner. The federal deposit insurance corporation fdic is an independent government agency in charge of banking and consumer safety. It said this is to notify the general public that all account holders in financial institutions banks insurance companies etc are required to obtain complete and submit self certification.

The balance of a joint account can exceed 250 000 and still be fully insured. Your deposits and products must be held in canadian dollars at a cdic member institution. As always the lower your risk level the lower your potential returns. Rich people became that way not because of interest on bank accounts but.

Ultimately the closest thing you can get to a sure thing is a deposit under the limits in an fdic insured bank account or ncusif insured credit union. The catch is that over long periods of time inflation can affect your savings. For example if a corporation owns a checking account with 150 000 and a cd for another 150 000 at the same bank the fdic only insures 250 000 not the remaining 50 000. Cdic insures deposits held in savings and chequing accounts.

The fdic insures up to 100 000 in an account however you may use multiple accounts each insured up to 100 000. Historically the fdic pays insurance within a few days after a bank closing usually the next business day by either 1 providing each depositor with a new account at another insured bank in an amount equal to the insured balance of their account at the failed bank or 2 by issuing a check to each depositor for the insured balance of their account at the failed bank. Most canadian banks are members of the canada deposit insurance corporation cdic. This means that an individual can have two or more fully insured accounts at one bank so long as each one is a different type of account.

Not all institutions are insured by the fdic.