What Is A Premium In Insurance

Insurance is a means of protection from financial loss.

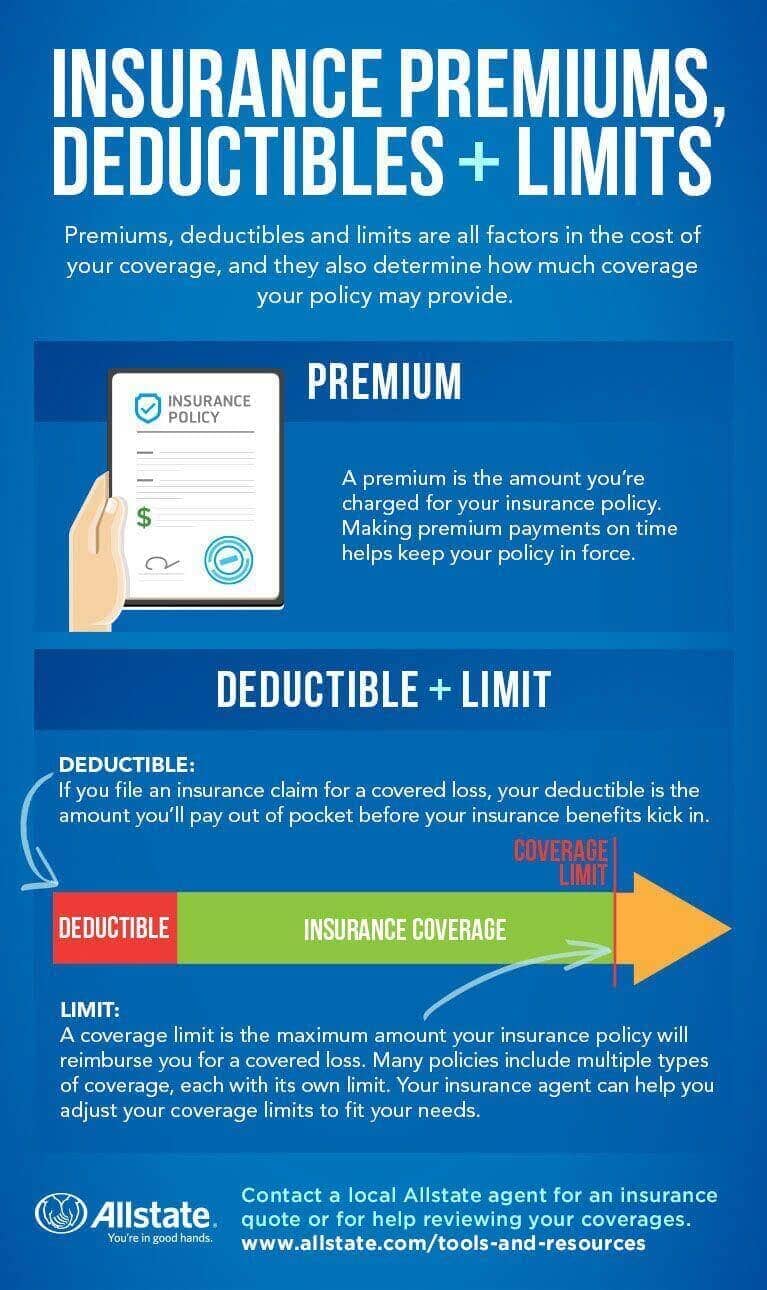

What is a premium in insurance. The insurance premium is the amount of money paid to the insurance company for the insurance policy you are purchasing. An insurance premium is the monthly or annual payment you make to an insurance company to keep your policy active. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss. Premiums are required for every type of insurance including health disability.

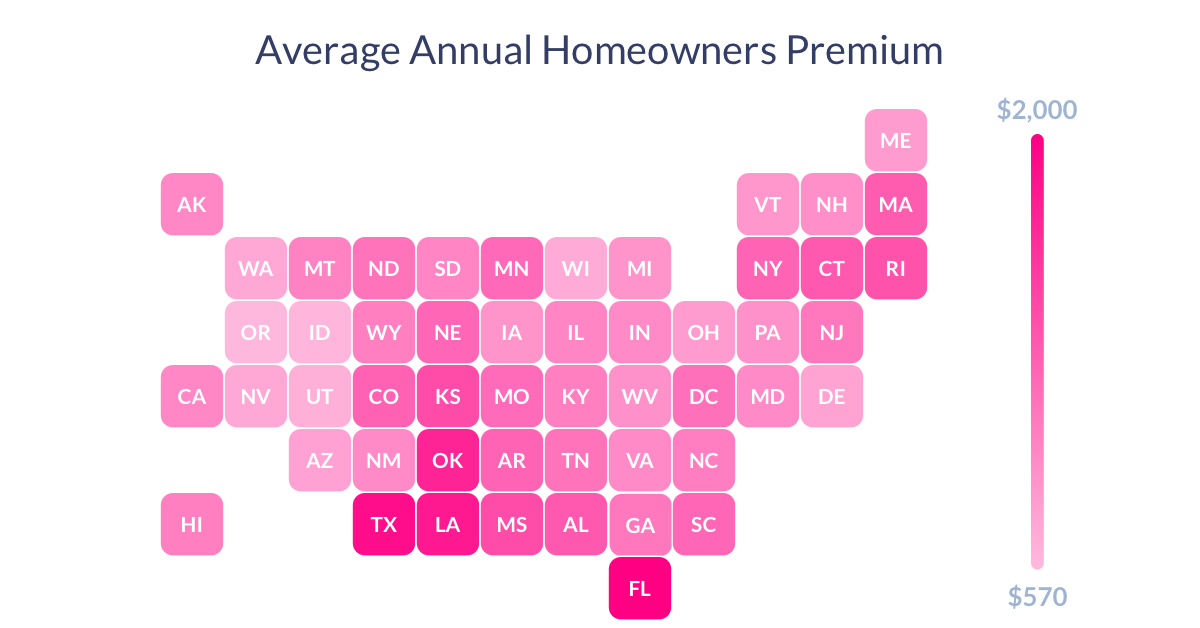

An insurance premium is the amount of money charged by a company for active coverage. Insurance premiums will vary depending on the type of coverage you are seeking. An entity which provides insurance is known as an insurer insurance company insurance carrier or underwriter a person or entity who buys insurance is known as an insured or as a policyholder. People pay these rates annually or in smaller payments over.

The loss constant helps protect insurers from losses associated. Your insurance history where you live and other factors are used as part of the calculation to determine the insurance premium price. The sum a person pays in premiums also referred to as the rate is determined by several factors including age health and the area a person lives in.