What S Needed To Refinance A Mortgage

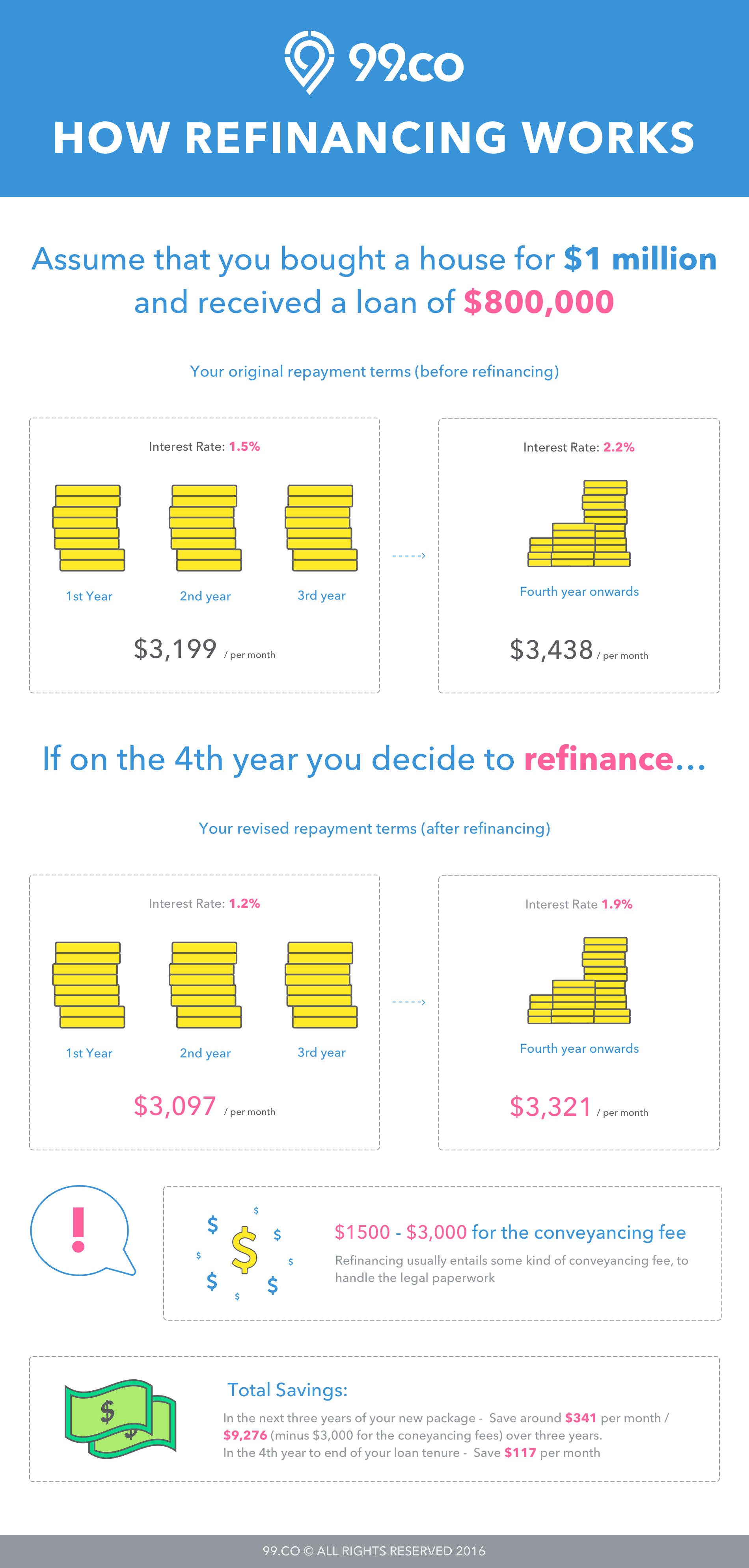

The cost of refinancing your house.

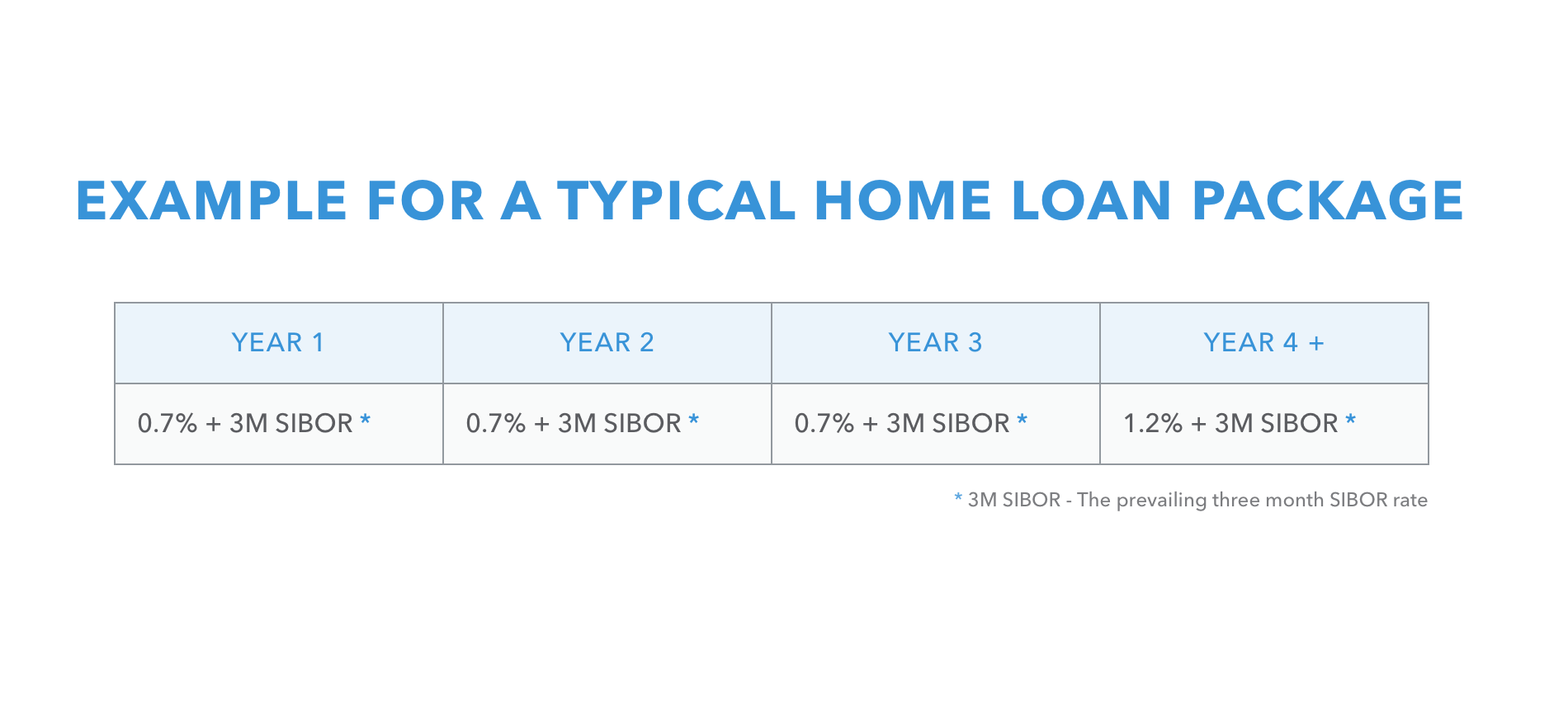

What s needed to refinance a mortgage. Interest paid on a traditional first mortgage loan or refinance is tax up to a limit of the interest on a 750 000 loan balance. Choice home mortgage will help you lower your mortgage payment or get cash out. Since refinancing can cost between 2 and 5 of a loan s. When you refinance you pay off your existing mortgage and create a new one.

However you can speed things up on your end by gathering all of the appropriate documents before starting the refinance process. Refinancing may remind you of what you went through in obtaining your original mortgage since you may encounter many of the same procedures and the same types of costs the second time around. Think back to your original mortgage and all of the documents that you had to gather. There are many reasons why homeowners refinance.

The displayed annual percentage rate apr is a measure of the cost to borrow money expressed as a yearly percentage. Refinancing a mortgage means paying off an existing loan and replacing it with a new one. This handy mortgage refinance checklist tells you what you need to do before refinancing. Qualifying to refinance an existing mortgage is virtually identical to qualifying for a new home loan notes both the federal reserve and bankrate.

The limit on second mortgage debt interest deductibility is the interest on up to 100 000 of second mortgage debt. Get your paperwork in order and know your refinance goals to speed up the process and save money. What documents do i need to refinance my mortgage. You may even decide to combine both a primary mortgage and a second mortgage into a new loan.

For a refinance the documentation for your refinance is pretty much the same. Any mortgage interest rates shown on the site are based on a 30 day rate lock period and subject to credit approval. As such borrowers must prove their mortgage worthiness by submitting the designated documents to the prospective lender.

:max_bytes(150000):strip_icc()/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)

/what-is-refinancing-315633-final-5c94f0874cedfd0001f16988.png)