Reverse Mortgage Definition Example

In most instances a reverse mortgage is paid off when the mortgaged home is sold.

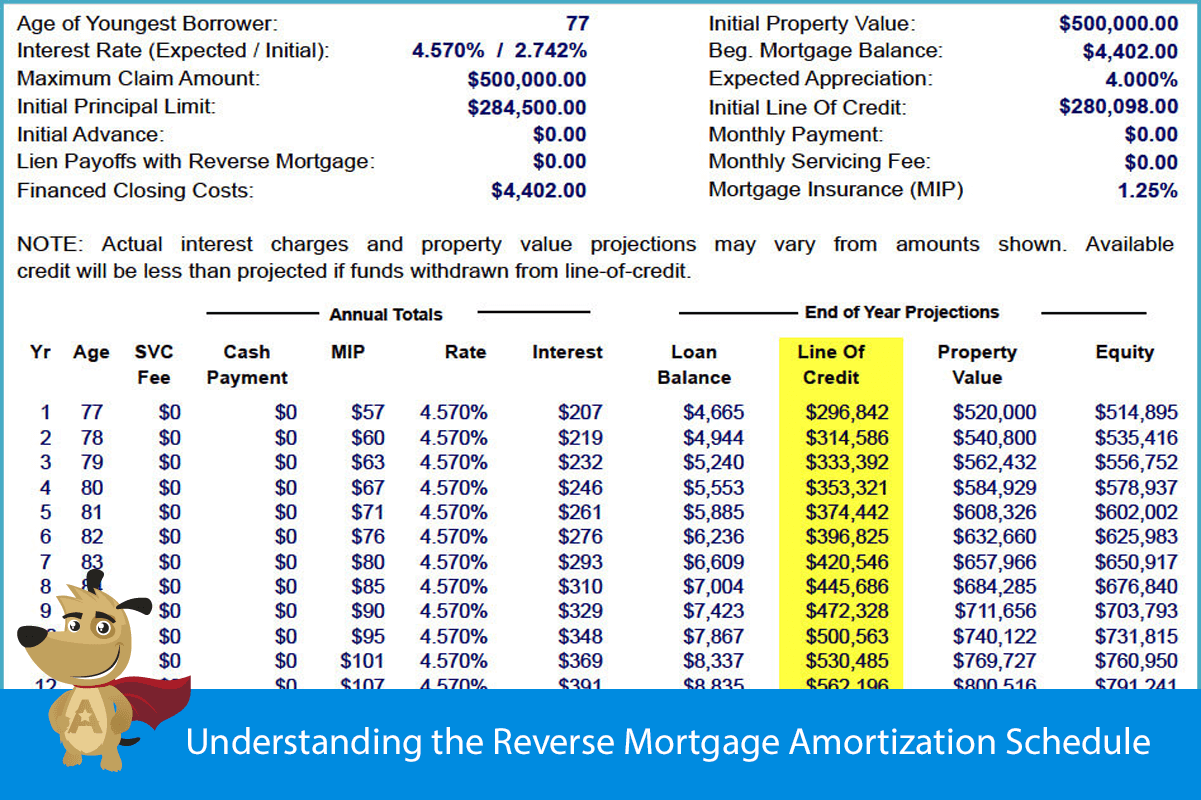

Reverse mortgage definition example. Modified tenure payment plan. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. A reverse mortgage is an arrangement whereby a homeowner borrows against his or her home equity and receives regular payments from the lender until the total payments reach a predetermined limit. Borrowers are still responsible for property taxes and homeowner s insurance.

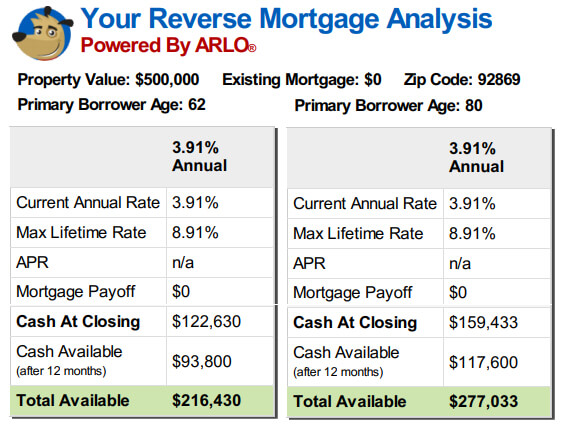

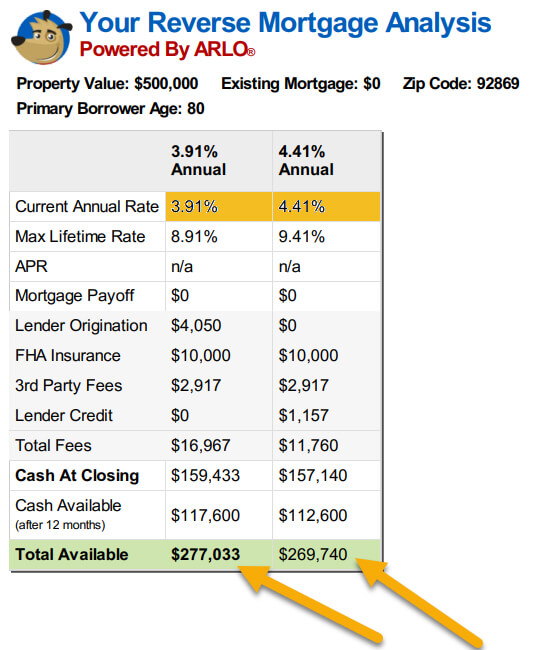

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Reverse mortgage definition example investinganswers. A reverse mortgage is a type of loan that provides you with cash by tapping into your home s equity it s technically a mortgage because your home acts as collateral for the loan but it s reverse because the lender pays you rather than the other way around. How much you can receive 3 examples a reverse mortgage is a loan that allows borrowers to use a portion of the equity in their homes to obtain cash that requires no monthly repayment for as long as the borrower continues to live in the home and meet the loan requirements.

It is important to note that reverse mortgages are designed so that the amount owed cannot exceed the value of the home.