Unsecured Business Loans For New Businesses

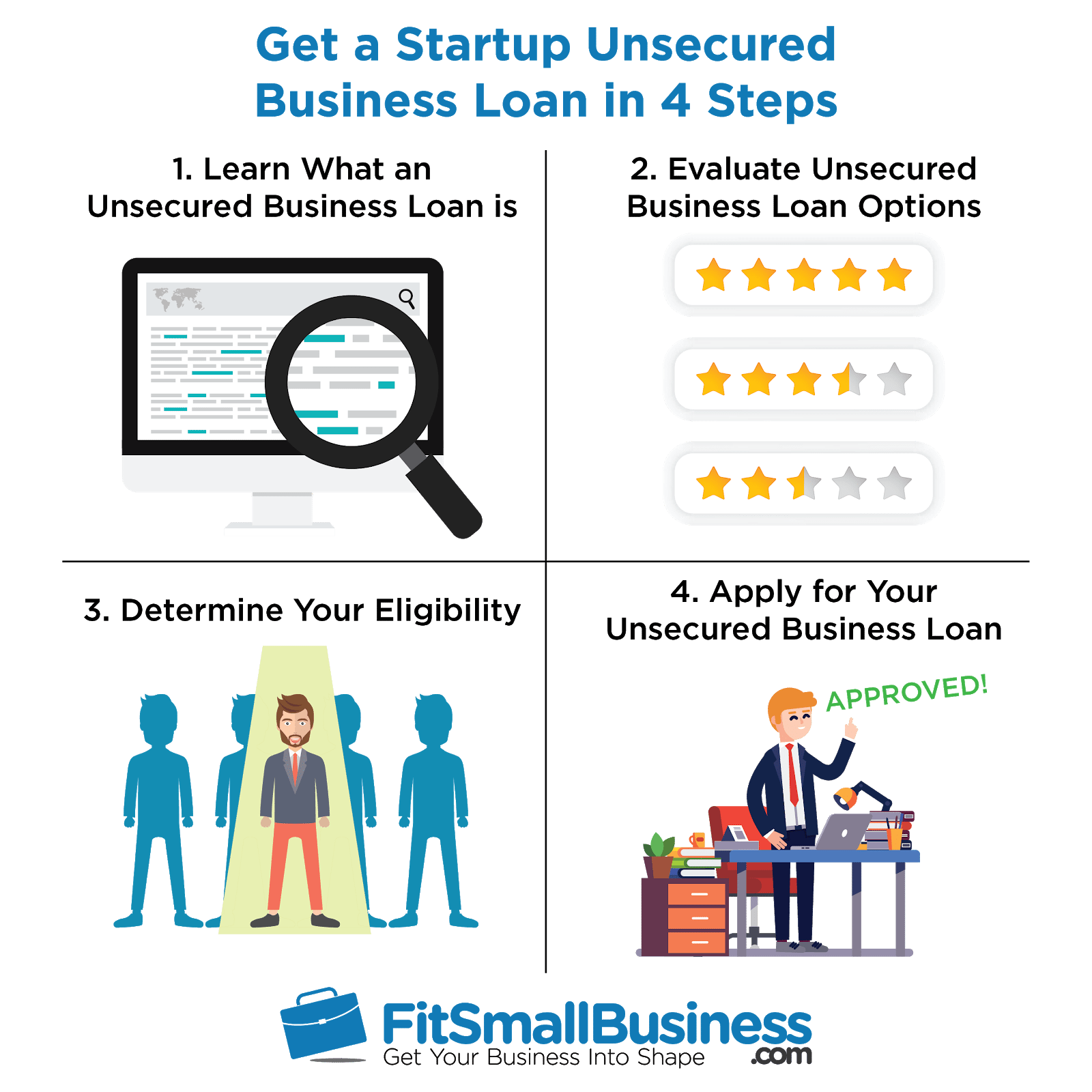

If you re a new company getting a business loan might be difficult.

Unsecured business loans for new businesses. Both well established businesses and relatively new ventures can enjoy a number of significant benefits. Compare apply online for up to 10 business loans including unsecured business loans and get the finance your business needs to grow. Under the scheme the government will provide a guarantee of 50 per cent to small and medium enterprise sme lenders for new unsecured loans to be used for working capital. New business loan customers can apply for loans under the scheme in the form of.

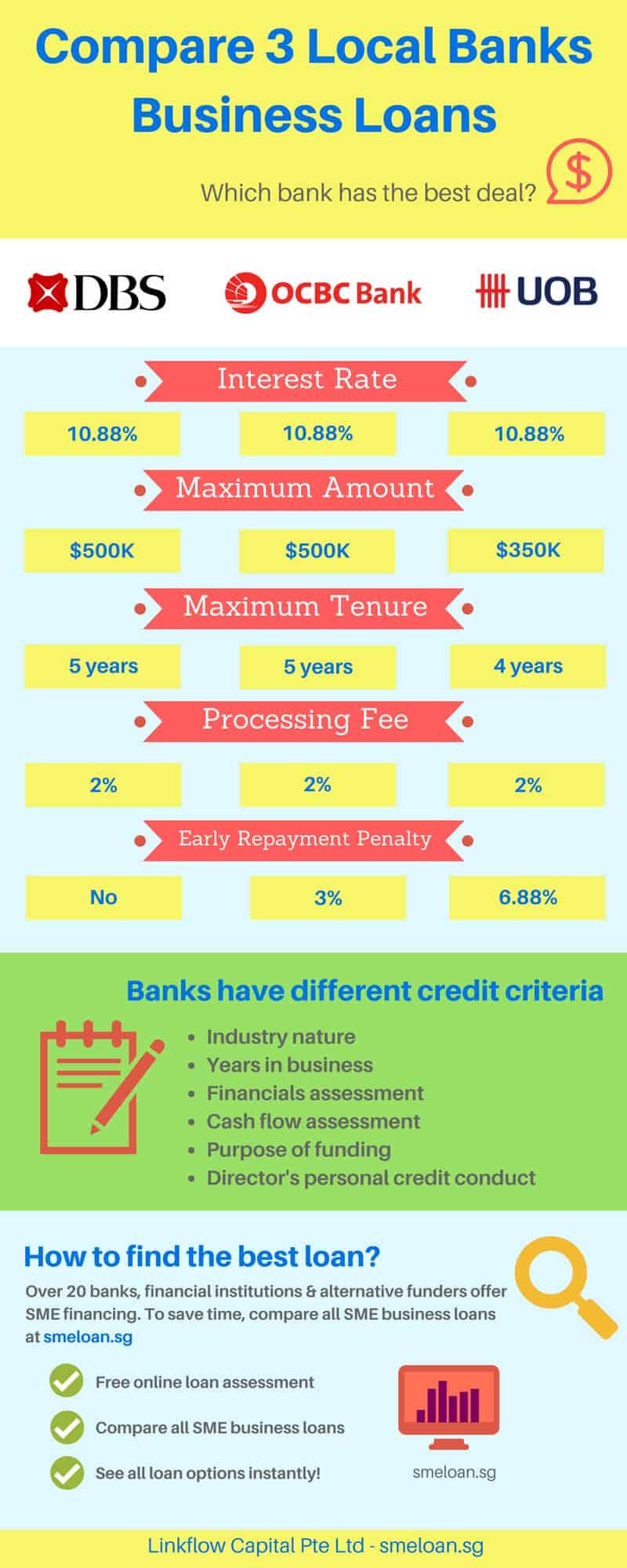

Unsecured business loans can help small businesses ease the financial demand of delayed payments and seasonality shifts. A small business loan can help your company grow by giving you the freedom to. While unsecured business loans don t require collateral and have a quick approval process an unsecured business loan also is typically costlier for the borrower with higher interest rates and personal guarantees. Pay for other business services.

Unsecured business loans quick. Invest in new equipment or inventory you can use an unsecured business loan to supply the working capital you need to restock your inventory and meet customer demand. These types of loans are a great option for new businesses and companies that don t have large asset pools. Plus established businesses often don t want to put personal assets such as the family home up as security.

Unsecured business loans are the solution. Unsecured business loans offer great advantages for businesses operating in the uk. If you are looking for small business funding funding for business sme funding smme funding business finance options private business loans funds for small business business investors company funding purchase order funding or invoice discounting finance apply now for quick. Unsecured business finance for small businesses in south africa is here.

In either of these scenarios getting a loan from a bank can seem impossible. The coronavirus sme guarantee scheme will provide support for these businesses. A three year business loan of up to 250 000 with a six month deferral on repayments with interest capitalised. Small business loans from 5 000 to 500 000.

Unsecured term loans are usually availed for a specific purpose such as procuring extra capital for the business. Lend is the fast hassle free way to get the best small business loans with the lowest interest rates. Term loans allow business owners to secure the necessary business loan without having to risk other personal assets such as properties which is usually the case for other kinds of business loans.