Reverse Mortgage Lending

By borrowing against their equity seniors get access to cash to.

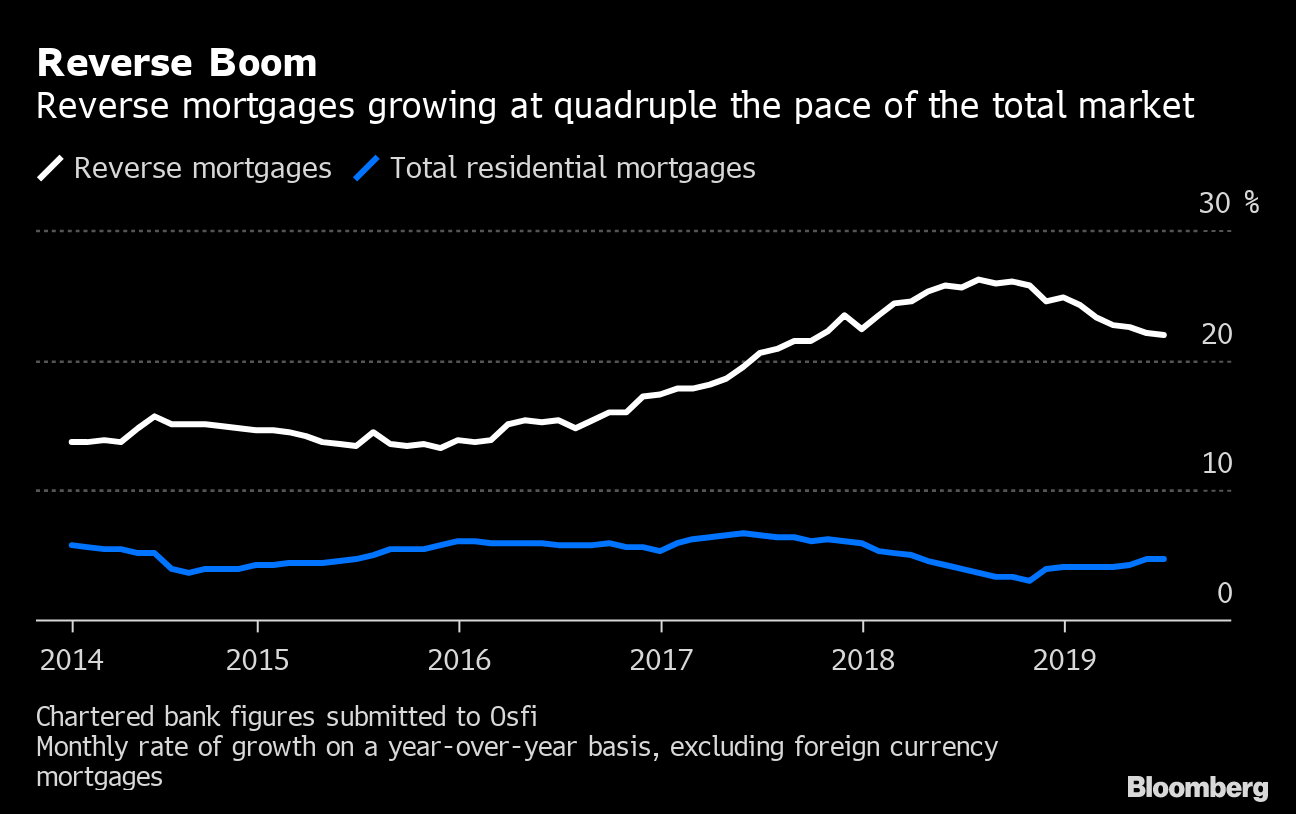

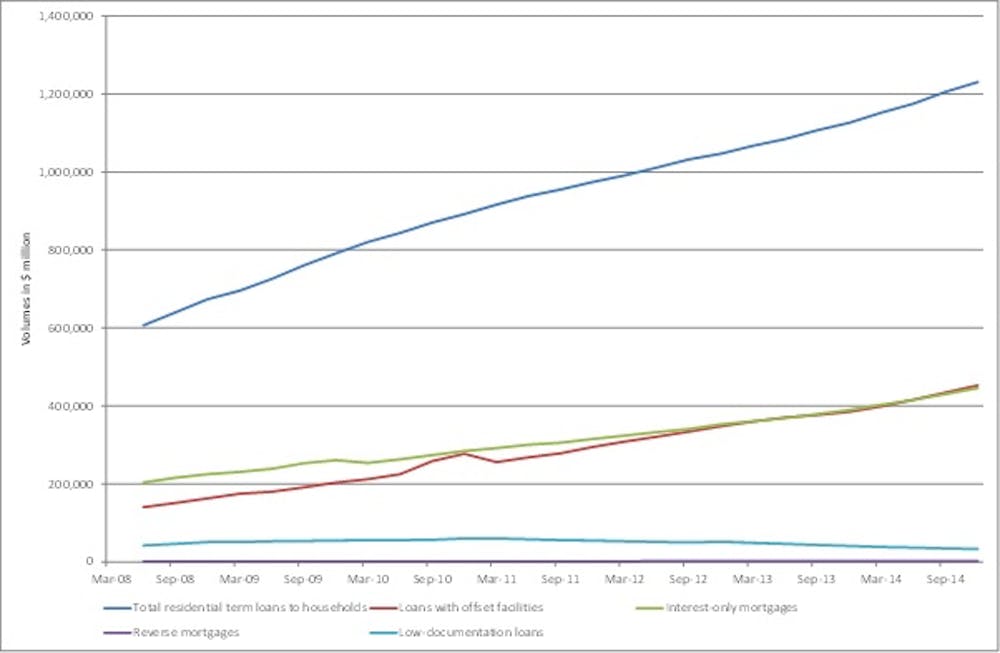

Reverse mortgage lending. A reverse mortgage is a loan based on the paid up current value or equity in your home. Unlike a conventional mortgage your lender pays you in monthly payments through a variable line of credit or in a lump sum. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. A reverse mortgage is a type of loan that s reserved for seniors age 62 and older and does not require monthly mortgage payments.

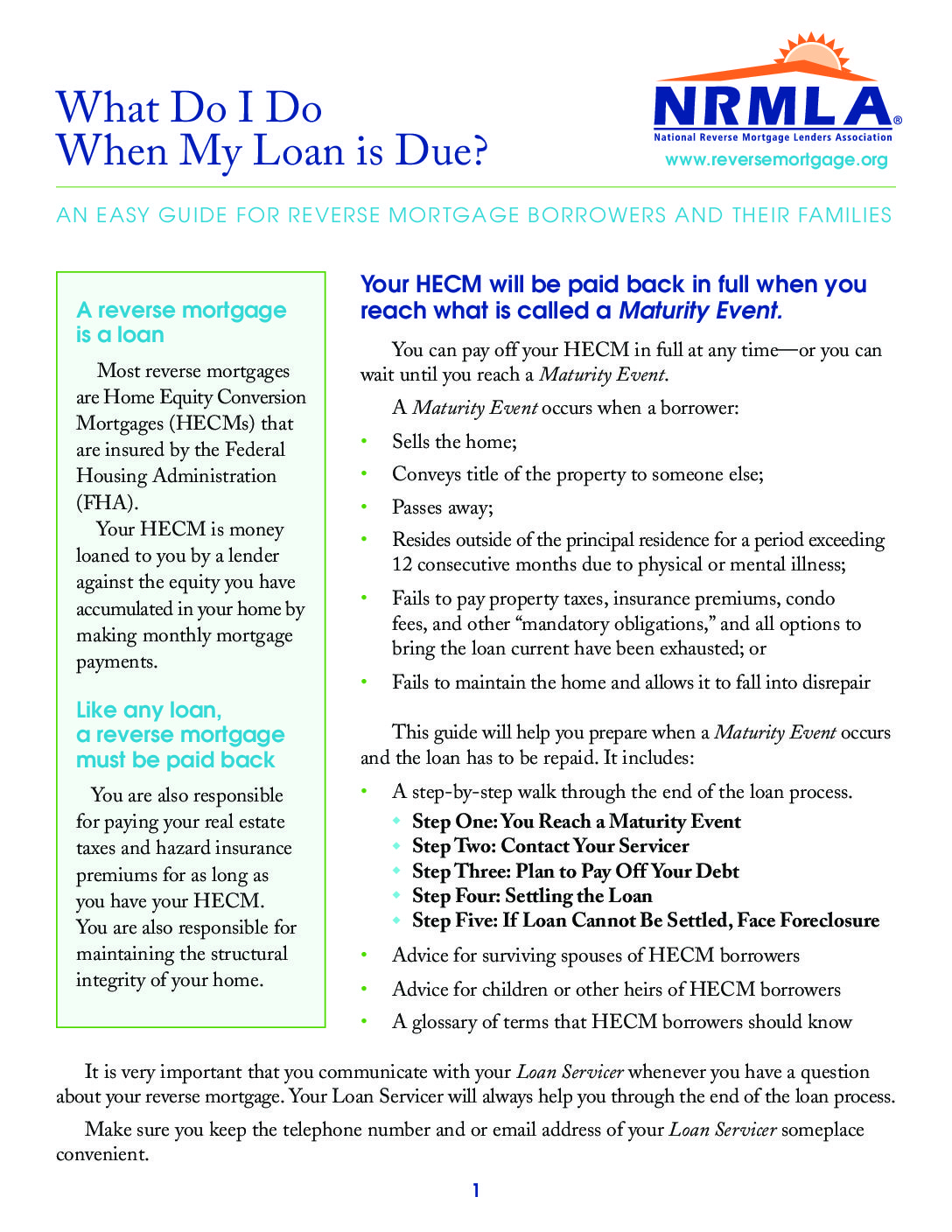

In a reverse mortgage the bank lends you a portion of the house s value using the house as security. Instead the loan is repaid after the borrower moves out or dies. Flexible reverse mortgage lending. If you re age 60 the most you can borrow is likely to be 15 20 of the value of your home.

So at 65 the most you can borrow will be about 20 25. How do reverse mortgages work. A reverse mortgage allows you to borrow money using the equity in your home as security. As a guide add 1 for each year over 60.

Borrowers are still responsible for property taxes and homeowner s insurance. You don t have to repay the loan until you sell your house move or die. In a reverse mortgage you get a loan in which the lender pays you reverse mortgages take part of the equity in your home and convert it into payments to you a kind of advance payment on your home equity. A way to receive reverse mortgage proceeds in which the borrower gets access to a line of credit as well as equal monthly payments for as long as he or she lives in.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. 2020 social security guide. When you have a regular mortgage you pay the lender every month to buy your home over time. A reverse mortgage home loan is a credit product type of equity release product erp where your loan is based on how much you own of your home the equity.

Modified tenure payment plan. Right now you may be considering loan options to help give you financial peace of mind. A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes.